This is total conjecture; please correct me in the comments, because I don’t understand finance at all. This is from a physics standpoint.

In markets, money flows against an information gradient. Traders with perfect knowledge of a stock’s value in the future can make trades with no risk, yielding the highest expectation values of returns E[R]. Traders with zero knowledge of the stock’s value have the worst expectation value. If the market is conservative–that is to say, there is no money added or lost inside the market itself; a stock sells for x dollars and is purchased for x dollars in each transaction, the sum of all expectation values over traders

S = Σ0^n E[R(tradern)]

must be zero. If the best-performing traders are making money (E[R] > 0), and the market is conservative or lossy (e.g. there are commissions on trades), then the worst-performing traders must be losing money (E[R] < 0) to keep S <= 0. In short, market transactions extract money from people with less predictive power over the transactions they engage in and move it to those with greater predictive power over the transactions they engage in. The actual distribution of winners and losers is probably an integral over the probability that a party engages in a trade times their predictive power around that trade.

So, HFT algorithms are making money, and I’m pretty sure the market is lossy. Where is the money coming from?

Or perhaps a more important question, if there is an information gradient generating positive returns for HFT, where does that asymmetry come from?

HFT has an information advantage over classical trading because the timescales over which it operates are quite short–so short that stock dynamics are essentially constant, and therefore readily predictable. That allows arbitrage (over the same stock in time, and between markets, I suppose) with a high degree of confidence that the stock you just bought won’t suddenly change in value shortly later.

But what about two HFT algorithms competing with each other? Now the timescale advantage is diminished because getting closer and closer to the market can only take you so far. It’s down to predictive power–which is hard to do well. But what if one party could disrupt the predictive power of the other by altering the market dynamics? Introducing random noise to the market would destroy the ability of both HFT algorithms to predict values efficiently, so that’s not going to help. However, if one party computes its interference in advance, then it can predict the market behavior more accurately because it has additional information about the stock’s dynamics.

What kind of intervention in the market would be sufficient to disrupt an HFT? Well it’d have to vary over short timescales, because otherwise the HFT is just gonna treat it as a constant. The intervention would need to be significant enough to actually show up in another HFT’s evaluation of the market: I’m guessing that means either high volume orders or prices outside the normal spread. It would also need to appear predictable in a way that other HFTs are susceptible to. If you just throw high-frequency pink noise or whatever into a stock price, any algorithm is going to see it and say “Well shit guys, I have no confidence about the future value, I’m taking my ball and going home.”

Compute your moves in advance, and then tell your own prediction algorithm to subtract your intervention from its model of the underlying time series dynamics. Then place your bid/sell orders on the market as planned. Other algorithms detect your offers and, assuming they’re indicative of predictable market behavior, begin placing orders. But your intervention dynamics aren’t predictable: they change rapidly and only you know when. So you, with superior knowledge of the market dynamics around that stock, can use your information advantage to extract money from the mispredictions of other HFTs.

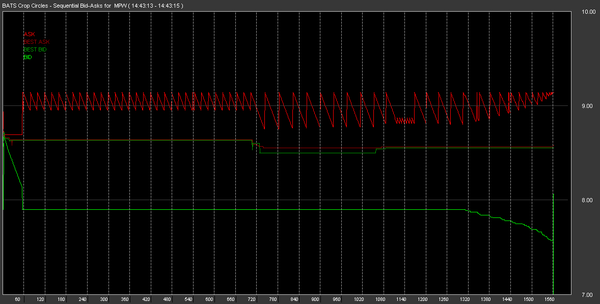

In summary, I’d expect to see a statistically significant, high frequency, piecewise-low-entropy, unstable signal in a price. Perhaps a piecewise linear function with sharp discontinuties on the scale of milliseconds.

Good breakdown, but it assumes a zero-sum game which the market is not (wealth can be created and destroyed). Its pretty well known in finance circles that HFTs employ obfuscation methods in order to prevent other traders from arb'ing on their strategies. ETFs don’t do this which is why they are getting killed of late. Part of HFT is figuring out which arbs to engage in and the other part is figuring out what arbs the other guy is engaging in and beating him to the punch.